Nt Capital SG is an asset management company, whose philosophy is summarized in professionalism, innovation, and sustainability.

FOUND NT DYNAMIC

ISIN Code Class R: SM000A1XFES2

ISIN Code Class I: SM000A401RJ6

ISIN Code Class P: SM000A401RK4

CURRENCY: EUR

FUND CATEGORY: FLEXIBLE BALANCED EUR

FUND MANAGEMENT TYPE: TOTAL RETURN

The investment objective of the Fund is to achieve a gradual increase of the value of invested capital to be pursued by combining capital growth and income on the Fund's assets through investment in a diversified portfolio of financial instruments of a bond and equity nature.

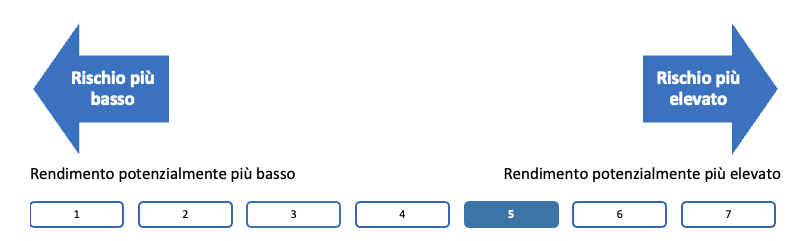

The Fund is addressed to individual retail investors (as well as institutional ones) who aim to achieve appreciation of the invested capital over a medium/long term and who are willing to accept a certain level of risk on the invested capital and an average level of volatility of the value of their own investments.

La SG attua una gestione di tipo dinamico con obiettivo di rendimento assoluto non correlato a particolari indici di riferimento e a rischio controllato.

La gestione orientata verso strumenti finanziari sia di natura azionaria che di natura obbligazionaria che i gestori valutano possano generare performance positive in qualsiasi situazione di mercato. The management activities provide the possibility of concentrating or suitably dividing investments according to the trend and prospects of the financial and currency markets, also making use of strategies based on derivative financial instruments. In particular, the financial instruments are selected using fundamental management techniques:

- bond and monetary side: they are based on the macro analysis of the main international economic variables (with particular attention to the monetary policies implemented by the Central Banks of the OECD countries) for the purposes of determining the weights to be attributed to the individual asset classes (distinguished by geographical areas, Countries, individual sector of membership, risk/performance characteristics), and on economic-financial, budget and credit analyses (capital ratios, debt levels, yield differentials with respect to risk-free assets) for the purpose of selecting the individual companies/issuers with the best growth prospects. The selection of bond financial instruments also presupposes a careful forecast analysis regarding the trend and evolution of interest rates, exchange rates and the quality of the issuers. Attention is focused on an adequate diversification of issuer risks, including those of a governmental nature or equivalent, having regard to the fundamental factors of the single entity and the overall composition of portfolio assets.

- Share side: the management policy is based on the macroeconomic analysis for the determination of the weights to be attributed to the geographical areas, countries and individual investment sectors and on economic-financial analyzes for the selection of the companies with the best growth prospects, i.e. those presenting expected growth rates higher than the market average (so-called growth style), or valuations lower than comparable market alternatives (so-called value style) in compliance with an adequate diversification of investments. The Fund doesn’t have specific goals in relation to the product sectors of the financial instruments in which it invests.